Why your bank may block your next Zelle payment

We all love easy and convenient things, like sending money using Zelle. But next time you try, it may not be that easy.

Zelle has become a go-to tool for sending money to friends, family, and even strangers online. Yet it comes with serious risks, especially when payments involve people you’ve only met through social media.

That’s because Zelle is like cash; once the money’s sent, it’s hard to get back. If you’re the one who actually sent the money, your bank is likely to say you authorized the transaction, and there’s nothing they can do to help you.

Because of this, many banks are adding security measures and reminders to consumers who use Zelle. NBC 7 Responds contacted major banks and asked about their strategies to protect customers.

Chase

Chase no longer allows customers to send Zelle payments identified as originating from contacts made through social media. The bank said about half of the scams reported by customers began on social media platforms. When sending money, customers may be asked questions about the payment, and the transaction could be blocked depending on their answers.

“Zelle is designed for sending money to others you know and trust, not for buying things on social media. We’ve updated the language in our Terms and Conditions to help our customers protect themselves from scams that overwhelmingly originate from contact through social media platforms.”

Citibank

Citibank sent us the following:

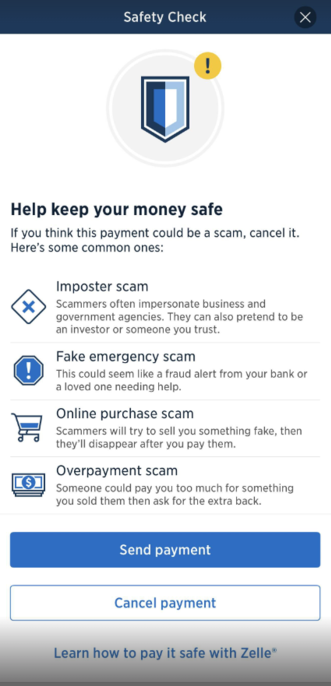

When Citi customers send money via Zelle, they encounter multiple layers of protection designed to alert them to potential risks before completing a transaction.

These include:

• Customers must complete an attestation that describes various fraud and scam scenarios, prompting them to assess and indicate if they might be a victim.

• A confirmation message displays the recipient’s full name, asking customers to reconfirm their intent to continue with the transaction.

• An alert reminds customers to exercise caution when sending money and highlights that funds may not be recoverable once sent, emphasizing the irreversibility of Zelle payments.

Beyond the transaction process, we also conduct proactive educational outreach through email campaigns to inform customers about identifying and avoiding fraud and scams.

Bank of America

Bank of America sent us the following:

Bank of America prioritizes client protection and takes action to mitigate risk to clients from scams. When sending money using Zelle and before completing the transaction, clients receive several pop-up messages alerting them to red-flags that indicate a scam including, as referenced, that we would never ask a client to send money to themselves or anyone and are encouraged to only send money to people they know personally.

- How to Identify a Bank Scam to Keep Your Account Safe

- Bank of America Fraud Prevention FAQs

- Report Suspicious Activities & Transactions on Accounts (bankofamerica.com)

- Privacy & Security Center at Bank of America

Wells Fargo

Wells Fargo sent us the following:

- Wells Fargo has a dedicated Online Security Center…to help educate our customers about scams.

- Zelle continues to be a very safe person-to-person payment option when sending money to people you know and trust. Zelle also provides an entire site dedicated to tips for paying safe: https://www.zelle.com/tips-safe-payments

- When using Zelle, Wells Fargo alerts our customers to double-check the recipient and reminds them to “only use Zelle to send money to people and businesses you trust.”

- We inform customers that Zelle is an immediate form of payment, just like cash. Scammers who receive payments from victims typically withdraw the funds from their financial institution immediately, making recovery difficult.

- When opening Zelle through the Wells Fargo Mobile app or Wells Fargo Online Banking, we alert customers to be on the lookout for scams. Customers who are sending money to a new recipient will see a confirmation prompt with the legally registered name of the account owner so they can check it against the recipient name they entered. This prompt also reminds our customer to only send money to people they know and trust. Before customers can finalize and send a payment, they view another alert that states “We’ll never ask you to pay anyone, including yourself. Once you send this payment, you can’t cancel it.”

Tips:

- Scams often start with a simple call, email, or text message impersonating a person or company you know to trick you into giving them your money.

- Wait & Validate: If you receive an unexpected text, email, or phone call, do not respond or click any links. Verify the legitimacy of the communication and request.

- Don’t be pressured or rushed into making a transaction: Scammers will try to rush you into taking action, so you won’t take time to stop, think, and verify facts.

- Verify Recipient: Only send money to someone you know, trust, and can confirm their identity. Once you approve sending the funds, the money leaves your account and is often unrecoverable.

- If you get any type of request by phone call, email, or text that you didn’t initiate, don’t respond. Contact the company or the person they are impersonating directly using legitimate sources.

- Be Vigilant and alert: Anyone can experience a scam. When in doubt, stop and get help.

US Bank

US Bank sent us the following:

In addition to educational efforts – including direct marketing to our clients to help create awareness of potential scams and what to be on the lookout for – we have a number of pop-ups throughout the user experience to help clients make informed decisions about who they send money to, this includes notifications that what they are requesting to do may be a scam if certain criteria are met. At the end of the day, it is important that you only send money to people you know.

USAA

USAA sent us the following:

At USAA, protecting our members is a top priority, especially as person-to-person payments grow. We focus on helping members send money safely and confidently by reinforcing the importance of only sending funds to people they know and trust.

When members set up new payment recipients, we provide in-the-moment educational prompts and on-screen reminders designed to help them pause, assess the situation, and avoid common scam tactics. These messages reinforce safe-use behaviors at the moments when they matter most.

In addition, USAA actively monitors transactional activity for potentially unusual behavior and takes appropriate action when concerns are identified. We continue to evolve our protections as fraud tactics change, combining education, monitoring, and ongoing enhancements to help safeguard our members’ money.

Capital One

We reached out to Capital One multiple times, and no one responded.

Zelle

Zelle referred us to its website.

Stay safe: Key recommendations

The bottom line: Only send money using Zelle to people you know and trust. If you believe you’ve been scammed:

- Contact your bank immediately.

- File a police report.

- Report it to the San Diego County District Attorney’s Office and the Federal Trade Commission.

Remember, once you send money via Zelle, you might never see those dollars again.